We support banks, other obliged entities and public authorities to improve the early-detection of ML threats and the assessment of ML risks through a wide array of services, which include: implementation of risk models and indicators, sensitivity analysis of AML classification models, provision of solutions for tracing beneficial ownership and training on-the-job on emerging AML threats and trends.

We build on Transcrime research and mapping of ML/TF schemes and patterns, including those in cyber environments

Our people sit as experts of international AML/CFT working groups, including national and supranational ML/TF risk assessments

Our people network and work together with the FATF, European Commission, AML/CFT supervisory authorities, FIUs and investigative agencies in the AML/CFT domain

Sensitivity analysis and predictive models

We carry out sensitivity analysis and consistency checks of the AML classification models currently employed by banks and obliged entities, and we support them in developing new predictive and detection models.

Risk and anomaly indicators

We can provide a wide array of risk and anomaly indicators, related to territory, sector, ownership/governance, financial/accounting dimensions, which can be applied in customer due diligence and AML/CFT threat detection.

Read the Risk Indicators Brochure.

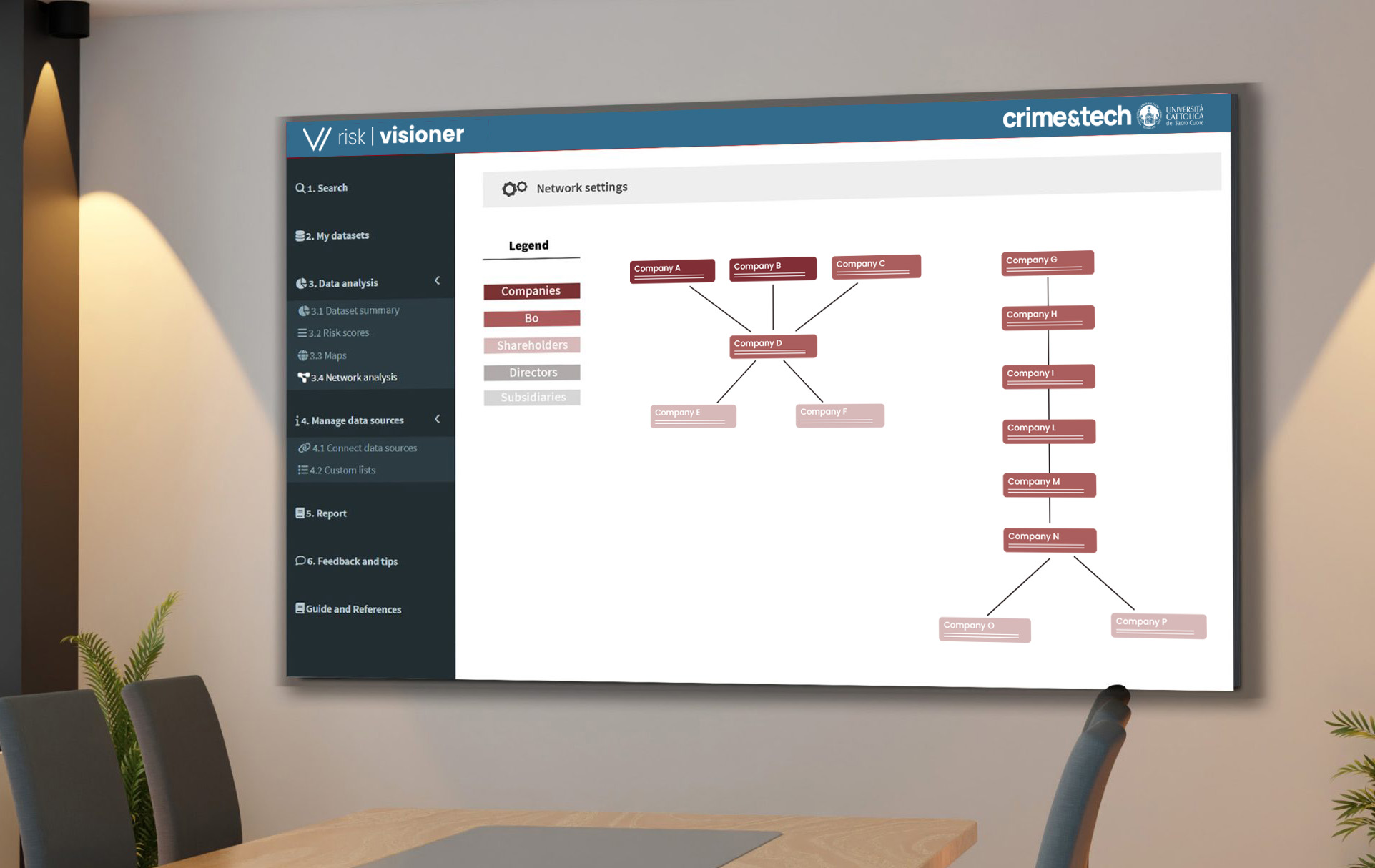

Ownership tracing solutions

We provide solutions to help identifying beneficial owners, and to trace complex corporate structures, including those spanning across borders. We process data from business registers, BO registers and global corporate data providers.

Discover RISK MASTER and RISK VISIONER.

Training on-the-job

We provide on-the-job-training to banks, professionals, financial intermediaries and public organisations on emerging AML/CFT issues, such as: beneficial ownership tracing, crypto-currencies, risk profiling techniques, new ML/TF threats.